What Does Summitpath Llp Do?

What Does Summitpath Llp Do?

Blog Article

Some Known Facts About Summitpath Llp.

Table of ContentsSummitpath Llp Things To Know Before You Get ThisSummitpath Llp - TruthsSome Known Questions About Summitpath Llp.The Greatest Guide To Summitpath LlpNot known Factual Statements About Summitpath Llp

That's where Bankeo is available in, your innovative partner for locating the excellent accountant. The Bankeo system renews the traditional relationship in between business owners and accountants by supplying a custom-made experience, so that every bookkeeping choice comes to be an extra lever for growth. https://summitp4th.carrd.co/. Establishing clear, measurable goals is the primary step in the direction of success

In this way, the accountant's work is not limited to straightforward tax reporting; he or she shapes a positive tax approach that contributes directly to making the most of internet revenue. Healthy and balanced capital is the lifeblood of any type of company pursuing lasting growth. Handling cash money flow is not something that can be improvisated - it needs sharp accounting knowledge and strenuous preparation.

Getting one more company is a significant tactical move that can change the competitive landscape of your market. An accounting professional plays a necessary tactical role in assessing the economic ramifications of such possibilities. Mindful planning is necessary to guarantee that the purchase is in line with the company's vision and the monetary realities of the market.

Get This Report about Summitpath Llp

In this means, he positions himself as a beneficial tactical consultant, educating the last choice and ensuring that the financial investment is synonymous with actual added worth for your business - tax planning. The framework of a firm is a figuring out aspect that affects not just daily monitoring but likewise investment technique. This is why the accounting professional, with his/her proficiency of figures and financial laws, ends up being an important gamer in developing a robust service framework

To begin on a business experience without the knowledge of an accountant is to sail the high seas without a compass. Bookkeeping, far from being a simple lawful obligation, is a beacon that lights the way for strategic and financial choices. An accountant does more than just give a record of deals; he or she is a true tactical partner, helping to shape your business's future with rigor and skill.

Take the helm of your economic strategy with Bankeo and ensure that every bookkeeping decision results in a chance for development. Technique begins here. Does success.

The Summitpath Llp Statements

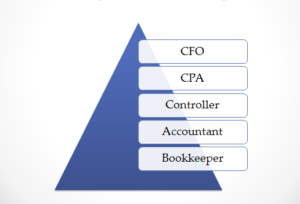

An is an expert who is in charge of keeping and analyzing financial records. Most accounting professionals are accountable for a wide variety of finance-related tasks, either for specific customers or for larger companies and organizations utilizing them. A number of various other terms are frequently reviewed in conjunction with the phrase "accountant," which can result in confusion on what this profession really involves.

Usually, accountants will certainly have earned a minimum of an associate degree and concentrate on tape-recording economic purchases. Accountants, on the various other hand, will certainly have generally gained a minimum of a bachelor's degree in accountancy, and are entrusted with analyzing financial details as opposed to just collecting it. In short, accounting professionals can be accountants yet not all bookkeepers are accounting professionals.

So, all CPAs are accountants, yet not all accounting professionals are Certified public accountants. Audit is a wide term that includes numerous various work titles and functions within organizations. There are three main kinds of accountantspublic accountants, management accounting professionals, and government accountantsall of which emphasis on different elements of the occupation. Inner and exterior auditors are also carefully associated.

See This Report about Summitpath Llp

Accounting professionals need to have the ability to listen very carefully in order to precisely gather realities and figures from clients, supervisors, or various other stakeholders. They should additionally be able to plainly verbalize the results of their work and present their searchings for in written reports. Specialists in this field require to be able to make use of innovative accountancy software and various other computer-based tools to function efficiently.

Without these concepts, an accounting professional will not last lengthy in the area. Because accounting professionals give customers financial recommendations, it is very important that they recognize money, understand the terms, and really feel comfortable browsing discussions around finances. While not every accountancy specialist calls for bookkeeping abilities, it can be a useful skill because it makes sure economic information is properly illustrated according to modern-day bookkeeping requirements.

Accounting professionals with one to 3 years of experience can gain between $57,000 to $70,000 per year. Those with five to seven years of experience can anticipate an ordinary typical income of $73,100. Bookkeeping professionals with ten plus years experience can gain up to $121,200 per year. Place additionally plays an important duty in establishing an accounting professional's making capacity.

Summitpath Llp for Beginners

Because of this, numerous professionals in the accounting area select to become Licensed Public Accountants, or CPAs, by finishing the licensing process carried out by the Organization of International Licensed Specialist Accountants. There are other career alternatives worth taking into consideration past a Certified Public Accounting Professional. The industry is full of a wide array of in-demand financing and accounting jobs.

Report this page